Renewable Energy Auction Design

by Silvana Tiedemann

Learning objectives

This chapter discusses how to design auctions for procuring renewable energy. At the end of the chapter the reader will be able to:

- Understand the relationship between an auction and a renewable energy support scheme

- Learn about the policy objectives connected to introducing auctions and the necessary conditions to meet them

- Get introduced to the most important design elements of auctions, such as the auction procedure, eligibility requirements, obligations, deadlines, penalties, and the institutional set-up

- Recognize advantages and disadvantages of different design elements choices

1. Introduction

Auctions. An auction is a mechanism to procure a good or service in a standardized, competitive manner. The auctions most familiar to the public are those used for the sale of artwork or on online platforms, in which the seller offers a product, potential buyers bid for this product, and the bidder with the highest offer wins. Auctions are artificially created markets on which market actors operate under pre-defined rules.

Game theory. The academic field related to the design and analysis of auctions is game theory (best known in policy sciences for the prisoner’s dilemma). Game theory is a mathematical theory to model how actors decide if they interact with each other. The theory normally assumes rational behavior according to a given incentive structure and body of rules. Setting the incentive structure and the rules correctly, is the “art of auction design”.

Auction for renewables. Renewable energy auctions entered the field in the mid-2000s, and since then, the number of countries using auctions for renewables has increased to around 70 by mid-2016 (IRENA 2017). Much like auctions conducted by independent power producers for conventional power plants in the past, renewable energy auctions are conducted as procurement auctions, i.e. the auctioneer offers a fixed volume in terms of budget or capacity. Renewable energy project developers act as bidders. They submit bids for gaining support from the government for the projects that they intend to construct. Bids are ranked according to the bid values and the less expensive bids are awarded first. After the auction, successful bidders are granted a certain time to “realize their bids”, i.e. construct the power plant.

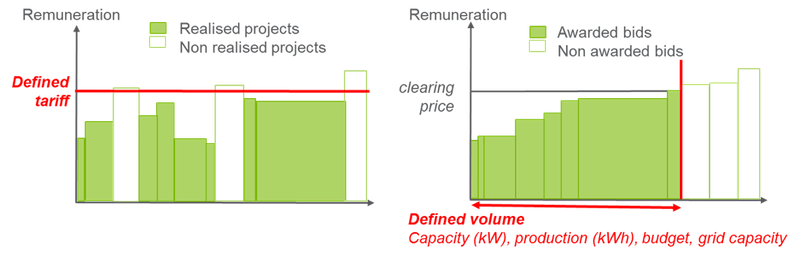

Auctions vs. support schemes. Auctions are often thought of as an alternative to renewable energy support schemes, such as feed-in tariffs (FiTs) or feed-in premiums (FiPs) that were discussed in RE support policies. But such comparisons are misleading. Auctions are nothing more and nothing less than an instrument for allocating (“Which bidder is chosen?”) and determining the level of support (“How much does the winner get?”) under a renewable support scheme. They should better be understood as components of support schemes rather than alternative to such schemes. An auction, thus, necessarily needs to be connected to a support scheme or power purchase agreement which determines the auctioned good (“What does the auctioneer want to procure?”) and the way the support is paid (“How is the winner paid?”). For example, in procuring renewable capacity to reach renewable energy targets, an auction can be used to determine the feed-in-tariff (FiT) that the winner of the auctions gets paid for each unit of electricity produced. Figure 1 compares an administratively set feed-in-tariff (left) to an auctioned one (right). Similarly, auctions can be combined with feed-in-premium systems to determine the premium.

Auctions vs. tenders vs. procurement process. In the context of procuring renewable energy, auctions are sometimes referred to as “tenders” and no clear distinction is made between the two terms. The same holds true for the term “procurement process”. If one wants to be precise, particularly if conducting game theoretical analysis, “auction” only refers to a narrow period: the time between opening the auction by inviting bidders to submit bids and closing the auction by selecting a winner. During the auction, bidders directly compete for a comparable good. A “tender” is a broader term. Bidders can be allowed to specify the good that they offer and thereby distinguish their offer from their competitors based on qualitative criteria. A tender may include an auction. The “procurement process” is even broader and can include the period during which the auction (or tender) is designed. One observes that governments more often refer to the entire process as either an “auction for renewables” or a “tender for renewables”, private actors or utilities as “procurement process for renewables”. The following does not distinguish between the three terms and just uses the term “auction”.

Objectives of RE auctions. Every auction is introduced with a purpose. The range of policy objectives and their prioritization differ from case to case and should be clearly defined. If not, the auction is likely to fail. In most cases auctions will have one or more of the following objectives.

Cost reduction. The most common policy objective is to “bring down cost of renewables”. Policy makers often refer to different dimensions of this objective: Reduce the overall system cost by selecting the less expensive projects, stabilize or reduce the overall budget that is allocated for renewables, incentivize cost-efficiency through competitive pressure, and support technological learning and progress. The focus here is on determining the level of support given to renewables in a competitive, market-based manner.

Figure 1. Price-based regulation of renewable energy procurement (left) vs. volume-based control with market-based price setting (right)

Key point: In a volume-based regulation, policy makers sets the volume, the market determines the price. Under a price-based regulation, policy makers define the remuneration, the market determines the volume.

Source: OEE

Notes: The graph illustrates the market under a price-based regulation (left) and a volume-based regulation with competition (right). In theory, both regulations could lead to the same result: the defined tariff equals the clearing price, the volume of realized projects meets the defined volume (see graph). This requires that policy makers adequately guess the clearing price, i.e. that they have very good knowledge on the market. In practice, this is often difficult as policy makers lack information on the market (problem of information asymmetry).

Cost discovery. Closely related to these objectives, yet somewhat different, is the objective to “discover the real cost” of renewables. In this case auctions shall overcome the information asymmetry between the project developers and the government: developers can estimate the amount of support they need much better than the government. Well-designed auctions can also limit the influence of renewable energy lobbies on the level of support given.

Volume control. A third prominent policy objective is to control, or at least influence, the overall volume and type of technology that is being built. To meet this objective, policymakers defines a (technology-specific) auction volume and need to ensure that bidders are willing, able, and obliged to realize awarded projects. In other words, the realization rate of successful bidders should be high and predictable.

Other objectives. Other policy objectives include a positive (local) socio-economic impact, a regional and technological distribution that is for example in line with the (planned) grid structure, actor diversity in the auction, job creation, attractiveness for foreign direct investment, and positive impulses for research and development.

2. Principles and elements of auction design

Auction design. To best design auctions that meet the policy maker’s objectives, policy makers should follow certain principles of good auction design, prioritize their objectives, and adjust the design accordingly. The following discusses the principles for a good auction design and introduces the design elements, that the policy maker has at his disposal to tailor the auction. While this discussion refers to auctions for renewable support schemes, the principles are more universal and apply to other types of procurement auctions, for example private auctions held by retail supply companies to procure electricity from independent power producers through power purchase agreements. The principles outlined below reflect the practical experience of renewable energy auctions in Germany and selected international case studies, which can be downloaded on the website of the research project Auctions for Renewable Energy Systems (AURES) .

Auctions need enough competition among project developers. The indifference value corresponds to the remuneration that a bidder at least requires to invest in the project. This value is often referred to as “true cost”. The idea of having an auction, is to create an environment in which bidders have an incentive to bid their true cost. The auctioneer can thereby “discover” the good’s real price. If there is enough competition, i.e. the demand by bidders exceeds the auctioned volume, participants have, in principle, an incentive to bid their “true cost”. Conversely, if demand does not, or only marginally, exceeds the auctioned volume, and bidders are aware of this, bidders will be relatively confident in placing a strategically high bid. This would lead to overpriced bids being awarded and increase the overall cost. In this case, the auction system would miss the objective of reducing cost. Every auction requires competition and the auctioneer should consider the risk of market concentration and market power. Market concentration occurs if the number of bidders decreases over time. An auction could lead to a more concentrated market if the auction design is more favorable for certain kinds of bidders, if some bidders are better positioned to withstand periods of intensive competition, or if some bidders already have a dominating market position which they can use to strategically influence the outcome of the auction.

The auction design should limit the additional risk for bidders. Auction participants, by definition, bear the risk of their bids not being selected despite the costs incurred by them in the pre-development of their project (“bid risk”). Similarly, auction winners run the risk of not being able to realize their projects or only with delays, and so face financial penalties (“penalty risk”). Because these risks are unavoidable, and participants are likely to incorporate the cost of these risks in their cost of capital (“risk premium”) and hence in their bids, auction design should focus on limiting such risks.

Limit transaction cost for bidders and the auctioneer. Transaction costs are costs associated with executing the administrative procedures necessary to take part in the auction (e.g. information procurement, compilation and examination of documents/forms, advice on bidding strategies, etc.). Whenever the transaction costs are high in comparison to the total anticipated profits participants may be discouraged from participating in the auction (IRENA 2015). The resulting reduction in competition can further create opportunities for exercising market power by larger players.

Decrease the likelihood of the winner’s curse. The winner’s curse occurs when a winner has underestimated her true costs, resulting in a negative profit. This may compromise the realization of projects or lead to bankruptcy. Winner’s curses are common if the cost of all bidders depends on the same factor, a so called common value. Examples of common values are the prices of PV modules and wind turbines, interest rates, and revenues from the electricity market. If these values are uncertain, bidders make estimations. The one with the lowest estimate wins yet this one is also likely to be the one that is wrong.

Design elements of an auction. So far, we have introduced principles that should guide the design of auctions. The following outlines the parameters which a policy maker has at its disposal to address the concerns, i.e. the design elements of an auction, which are the parameters that make up the regulatory set-up of the auction. In other words, these are the rules according to which the auction operates. These parameters can be grouped into five categories:

| Category | Design elements |

|---|---|

| 1. General auction elements | Auctioned good and volume |

| Auctioned award | |

| Eligible technologies | |

| Multi vs. single item auction | |

| 2. Auction procedure | Auction format |

| Ranking criteria | |

| Pricing rule | |

| Maximal and minimal price | |

| Auction frequency | |

| Auction schedule | |

| 3. Eligibility requirements | Material pre-qualification |

| Financial guarantees (bid bonds) | |

| Bidder qualification | |

| Detailed technological design | |

| 4. Obligations, deadlines and penalties | Deadlines |

| Penalties | |

| Transferability | |

| 5. Institutional set-up | Auction designer |

| Auctioneer | |

| Contract off-taker |

3. General design elements

Before any auction starts one needs to define what is on offer (the auctioned good), how much is on offer (the auction volume) and how the winner gets remunerated (the auction award). In case of auctions for renewable energy, policy makers also need to consider what kind of generation technologies will be allowed to participate (technology specific vs. technology neutral auctions) as this can substantially alter the results of the auction. Lastly, auctions function according to a different dynamic if designed as multi- or as single item auction.

3.1. Auction good, auction volume and auction award

In renewable energy auctions, the auctioned good and its volume is often defined in terms of the power capacity (in MW) or energy production (in MWh) to be procured and usually depends on the national renewable energy target. The type of auction award depends on the support scheme. These elements are of crucial importance but depend on the choice of the support scheme. Therefore, they will not be discussed further.

3.2. Eligible technologies

Renewable energy auctions can be technology-specific, technology-neutral or run as multi-technology auctions (also called grouped auction). In general, the distinction between the three is made according to the resource type (wind onshore, wind offshore, PV, biomass, biogas, hydro, etc.) used for electricity generation. For example, if in an auction, an onshore wind project competes against other onshore wind projects, the auction would be considered as technology-specific. An auction would be considered as grouped if wind onshore competes against photovoltaic plants and would be considered as technology-neutral if the auctioneer does not specify which technologies are eligible.

Technology-specific auctions. In these auctions the policy maker specifies the volume to be procured from each type of technology before the auction takes place. While the awarded technologies are the most cost-efficient of their kind, the overall selection of technologies may increase support required. Naturally, projects of the less competitive technology, which would lose out in a technology-neutral auction, may be awarded in a technology-specific one.

Technology-neutral auctions. In such auctions the technology that needs the minimum level of support is likely to win. The outcome is cost-efficient in the sense that the overall targeted volume of renewables is contracted at minimal support cost. The market defines the contracted volume per technology, not the policy maker. The liquidity of the market is higher (particularly important in small markets) and the competition increases.

International examples. The United Kingdom and California (USA) have implemented multi-technology auctions. The UK established groups differentiating between mature (e.g. onshore wind, solar PV) and immature technologies (e.g. offshore wind). California targeted a certain level of technology diversity by defining three groups: baseload, peaking, and non-peaking. The Netherlands opted for technology-neutral, Germany and France for technology specific auctions.

3.3. Multi vs. single item auction

In a single-item auction, only one predefined good is on offer, e.g. the area for constructing an offshore wind farm. Several bidders can participate in the auction. The winner gets access to the good, i.e. can build and operate the wind farm. In a multi-item auction several bidders with their own projects compete. More than one project can be awarded. Multi-item auctions are the rule in solar and wind onshore auctions, single-item auctions often found for offshore wind, where project size is considerably larger and projects differ significantly between each other.

Figure 2. Multi- vs. single item auctions

Key point: In a single-item auction several bidders compete for one project. In a multi-item auction, bidders compete with several projects.

Source: OEE

Notes: A single-item auction defines one good for which bidders compete. Only one winner exists. In a multi-item auction, several bidders compete with different projects. One or more projects can be awarded.

Single-item auctions. In such auctions the government or a governmental agency is normally responsible for the first stages of project planning. For example, in 2013, the Netherlands opted for a single-item auction system for offshore wind, for which the first round of auctions was held in July 2016. The government selected the suitable sites and obtained the required permits. The grid operator was responsible for grid planning and development. Private developers acquired the permits and the right to develop the site through the auction and are, as such, only responsible for the detailed technical planning and project development. Such auctions allow governments to control and coordinate the initial stages of projects and find solutions for conflicting interests which might be required when the industry is in initial stages of development. In such a setup the costs for private developers decreases, as the government bears the finical risk from projects failing at an early stage. At the same time, the government needs to have, or contract, the required technical expertise. Additionally, there is no competition for cost reduction at the earliest stages of development.

Multi-item auction. A multi-item auction for to the example of the offshore wind farm would function as follow: private developers take responsibility for most of the planning stages including site selection, investigation, securing permits, and, depending on the regulatory framework, grid development. The government is only involved as a counterparty to the private developer, i.e. to negotiate terms for the usage of public land (often the case in maritime environments) or in the facilitating the required permits. Private developers can exercise their full technical know-how and experience and thereby benefit from competitive advantages. At the same time, they must bear the risk of failing projects which can increase cost.

4. Auction procedure

Components of the auction procedure. The auction procedure is the heart of the entire auction. Remember, game theory even only refers to the auction procedure when taking about auctions. The auction procedure sets the rules of the market and determines the type of competition between bidders. The most important components are the auction format, the criteria which determine the ranking, the pricing rule, the existence of maximum and minimum prices, discriminatory factors, and the frequency of rounds. These parameters are discussed in detail below. Of less strategic importance, but not negligible from a policy maker’s perspective, are factors like scheduling of the auction dates. For example, if a biomass auction is scheduled during harvesting season the level of competition is likely to be lower. Farmers will not have time to submit bids.

4.1. Auction format

The auction format determines how the auction takes place. The most common mechanisms are sealed-bid auctions, ascending/descending clock auctions or hybrids of these two formats.

Sealed bid auctions. In a sealed-bid auction, participants submit their bids simultaneously and are unaware of the competitors’ bids (see left panel of Figure 3). An auctioneer ranks and awards projects until the cumulative volume is equal to the volume being auctioned. Given that bids are submitted only once and no interaction or reaction to the competitors’ bids is possible, the sealed-bid auction is called “static”. The auctioneer gains information on the market price (“price discovery”), bidders do not. They cannot react to the market’s signals which leads to low risk of collusive behavior among bidders but an increased risk of the winner’s curse.

Figure 3. Comparison between a static and a dynamic auction

Key point: Static auctions are “one shot games”, dynamic auctions happen in succeeding rounds with disclose information on the level of competition to the bidders.

Source: OEE

Notes: The picture compares a static with a dynamic auction procedure. In a static auction (left), bidders submit binding bids. Bids are ranked and awarded until the volume is reached. The right picture figures an ascending clock auction as one example of a dynamic auction. In each round, the auctioneer increases the level of remuneration. Bidders can offer a bid at the given level of remuneration. If the offered volume is below the available volume, the auctioneer opens a new round by increasing the price level. The procedure continues until the available volume is reached.

Ascending clock auctions. In contrast to a sealed-bid auction, an ascending clock auction is dynamic (see right panel of Figure 3). A dynamic auction consists of several phases in which bidders receive information on the level of competition at a certain price. In an ascending clock auction, the auctioneer declares the maximum “prices” or remuneration for each phase (“Remuneration in cents € /kWh” in the graph). The first phase begins with a relatively low price. Bidders willing to realize a project at this price submit a bid and receive an award, provided the auction volume has not been exhausted. In the next phase, the auctioneer increases the remuneration and invites bidders to submit further bids. The procedure is repeated until the volume defined for the entire auction round is reached. Bidders that wait until later rounds could benefit from higher remuneration but they run the risk that the auction will be closed before (Tiedemann et al. 2016).

Descending clock auctions. In a descending clock auction, the auctioneer starts by calling a high remuneration and asking bidders to state the volume they wish to offer at such a remuneration. If the cumulative volume offered exceeds the volume to be procured, the auctioneer lowers the remuneration, and again invites bidders to declare if they still offer the volume they have committed to in earlier rounds or if they reduce the volume. This process continues until the quantity offered matches the quantity to be procured or until excess supply is negligible (Maurer and Barroso 2011). The winners are those bidders who still offer volume at a remuneration level at which supply equals demand. The descending clock auction is the second major representative of dynamic auctions.

Gaining information on uncertain common value goods. Dynamic auctions have one major advantage: bidders gain information on the price estimations by their competitors and adjust their bids accordingly. What sounds like a risk for implicit collusion (which it is) can still be well suited in situations with a major risk for the winner’s curse due to an unknown common value (see above). If the value is unknown, it is likely that some bidders over-, others underestimate the real value. In a static auction, the bidder with the most ambitious price estimate is likely to win. In a dynamic auction, a bidder will get the information that she would likely win the round given her price estimate. If she is skillful, she can adjust her estimate and therefore her bid based on the information gained in the auction.

Hybrid auctions. Such auctions have static and dynamic elements and thus combine the advantages of both types of auctions. A hybrid auction may, for example, include a first phase with an ascending or descending clock auction, followed by a second phase using a sealed bid auction. The objective of the first phase is to provide some price discovery for the bidders, and the second phase still discourages collusion. The disadvantage is that these formats are less transparent and more complex (AURES 2017). For renewable energies, such hybrid auctions have been implemented in Brazil in the past.

4.2 Ranking criteria

Ranking criteria determine the order of bids. So far, we discussed price-based selection criteria, but there are alternatives: qualitative criteria such as environmental benefits, local content, system integration benefits, envisaged commissioning date, etc. A price-based ranking has the advantage that only the bids with the lowest prices will be awarded, which leads to a cost-effective selection and contributes to the goal of a cost-efficient allocation (Klessmann et al. 2015). In a purely price-based auction, however, any additional objectives for the promotion of renewable energies can only be controlled via pre-qualification requirements or measures outside the auction system. Qualitative criteria may help to reflect these objectives during the auction.

4.3 Pricing rule

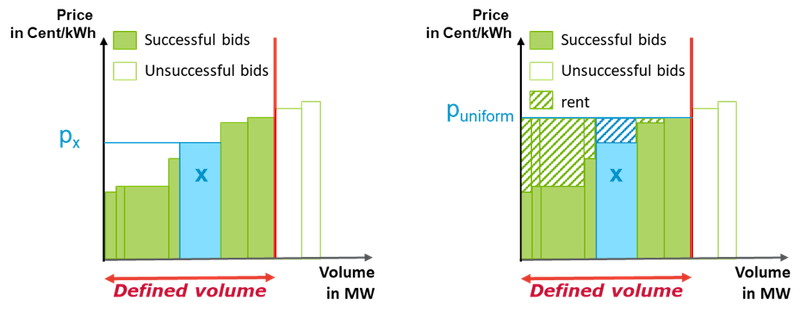

The pricing rule determines the value at which winning bids are remunerated. The most frequently used pricing rules are the pay-as-bid rule and a uniform pricing rule (also called pay-as-cleared).

Pay-as-bid. Under this rule each successful bid receives its bid price. For illustration, consider the different bids received in an auction in Figure 4. The left panel shown the price received by each bidder under the pay-as-bid rule: the project marked x would receive the remuneration or price px. This pricing rule is relatively easy to understand and generally perceived as “fair” by the auction participants and the public, and thus enjoys high acceptance. However, as this pricing rule leads to different remuneration levels across bidders, it provides an incentive for bidders to place bids above their true costs (“bid shading”). The extent to which bidders “exaggerate” their bids depends on their assessment of the level of competition. Under a pay-as-bid pricing rule, bidders with good knowledge of the market have an advantage over those who do not. It can also be shown that the pricing rule favors bidders with a larger portfolio or better market intelligence.

Figure 4. Pricing rules compared

Key point: The bid value determines the level of remuneration under a pay-as-bid pricing rule, the clearing price under a uniform pricing rule.

Source: OEE

Notes: The figure explains the pay-as-bid (left) and the uniform (right) pricing rule. Under the pay-as-bid pricing rule, the project x gets remunerated with its bid value px. The same project gets the clearing price puniform (here set by the last accepted bid), independently of its own bid price, and receives an additional rent.

Uniform-pricing. If this rule is applied, all winning bids receive the same clearing price. In the right panel of Figure 4, all the projects would receive the market clearing price p uniform, which is here determined by the last successful bid. Please note that in theory, the market clearing price should be determined by the first rejected bid yet policy makers often choose the pictured variant of the rule.

Bidding true cost. The main advantage of the uniform pricing rule is that bidders have an incentive to submit bids at their indifference value, often referred to as their “true cost”. Every bid receives an automatic mark-up on their bid price which corresponds to the difference between the clearing price and their bid price. If they win the auction, they are sure to not set the price level. Hence, if a bidder submits a bid that is above its true cost, the bidder only reduces its chances of winning but does not increase its chance of receiving a higher remuneration. No information on the level of competition is needed.

Limitations in case of multi-round and multi-bid auctions. This argument only applies in very specific circumstances. As soon as bidders can submit bids for several projects per round (multi-item auction) and/or several rounds exist, the nature of their incentives changes and the advantage of the uniform pricing rule becomes less virulent. In multi-round auctions bidder have the incentive to increase their bids above the indifference value in all but the very last round. In multi-item auctions, there is a chance that the second bid sets the price for the first one, if bidders submit more than one bid. Hence the dominant strategy would be to bid the indifference value for the first bid and submit a price above the indifference value for the second one.

Pay-as-bid for immature markets. Both pricing rules can lead to cost reductions. In practice, pay-as-bid has proven to be more robust against undesired, strategic incentives. The uniform pricing rule is rather prone to incidences of underbidding and may be less suitable for a non-mature market or for a market with inexperienced bidders. If a sufficiently high level of competition exists and bidders are likely to bid rationally, uniform pricing should be considered.

4.4 Maximum and minimum price

Regardless of the pricing rule, there is the possibility to set a maximum price (or price ceiling). The auctioneer rejects bids above the ceiling price. A price ceiling can reflect the auctioneer’s willingness to pay or limit the risk of high cost due to limited competition or collusive behavior. A minimum price can reduce the winner’s curse. As disadvantages, maximum and minimum m prices give a signal to the bidder. Particularly in case of low competition, bidders are likely to adjust their bid price to the ceiling level rather than to their indifference value. The maximum price therefore distorts the market (Klessmann et al. 2015). For this reason, price ceilings are sometimes kept secret. For the auctioneer, determining an appropriate ceiling price also entails additional administrative effort.

4.5 Discriminatory auction

Discriminatory auctions. So far, we assumed that the chances of winning only depend on the bid price or other objectively comparable ranking criteria. Some policy objectives can easier be serviced by using discriminatory elements. Discriminatory auctions explicitly influence the competition in favor of some bidders or their bids. This can be done via quota/segments (“volume-based discrimination”) or boni (“price-based discrimination”). Discrimination aims to guarantee that a certain amount of the auctioned volume goes to the privileged bids (quota) or increase the likelihood (boni) that they win. This can help meeting policy goals like guaranteeing a certain geographical distribution of projects due to grid issues or incentivizing a heterogenous selection of winning actors by providing a bonus to small local actors which may increase acceptance values for renewable energies. Discrimination can also increase competition between heterogeneous goods, i.e. if a small fraction of projects has an outstandingly good cost structure compared to the majority of the projects. On the downside, discrimination tends to decrease static efficiency of auctions.

Justification and examples of discrimination. Common factors with which discrimination is justified are the size of projects, the types of actors, technological and geographical criteria. For example, the Indian state of Punjab’s 2013 solar auction introduced a quota to encourage the participation of small and/or new actors. A portion of the auction volume (50 MW) was reserved to relatively small-scale projects (1-4 MW), and only newly established companies could participate. The remaining 250 MW was reserved for well-established companies with project sizes of 5-30 MW (IRENA 2015).

4.6 Auction frequency

Definition. The auction frequency defines how many rounds take place during a given time. If there is more than on auction round, we speak of multi-round auctions. The game theoretical considerations and strategic incentives change (see above) if two rounds take place within a time frame that allows bidders to resubmit bids without major cost.

High and low frequencies compared. A low frequency reduces administrative burden and increases the liquidity in one round but it creates the risk of discontinuous business development (“stop-and-go”) for project developers and manufacturers. A high frequency leads to greater continuity for project developers and manufacturers, which increases planning certainty but may create a “narrow market” problem in each round, reducing the level of competition (del Rio 2015). Having more frequent rounds can be particularly beneficial at the beginning of auction implementation, since it allows gaining experience more quickly and thereby adjusting the auction in case of need. A high frequency, however, also increases the risk that bidders may behave in a “collusive” manner (e.g. by refraining from bidding to increase the price level), thus obtaining an unnecessarily high profit. The definition of a “high” and “lower” frequency also depends on the specific market environment and the technology under consideration: fewer rounds may be a better fit for technologies with potentially fewer actors and winners and high cost of preparing a bid (e.g. offshore wind), and more frequent rounds for those with more potential participants and winners but lower cost for preparing a bid (e.g. solar PV) (del Rio 2015). If one actor refrains from one round e.g. due to capacity problems or other opportunities, the impact would be negligible in the latter yet of major importance in the former case. If several winners exist, the value chain becomes better utilized and cost can decrease, if the frequency is higher.

5. Eligibility requirements

Why eligibility requirements. Bidders and their bids need to comply with so called eligibility or pre-qualification requirements. Pre-qualification requirements are intended to ensure the seriousness of the bids, i.e. to prevent bidders from participating without wanting to implement the project. Pre-qualification requirements are imposed to increase the realization rate.

The art of auction design. Setting pre-qualification requirements should be done carefully. They require investments under uncertainty and therefore increase risks and may deter parties from participating. The latter has negative impacts on the level of competition (Klessmann et al. 2015). The “art of auction design” is to strike the right balance between pre-qualification requirements and financial guarantees. Both are explained below. Further aspects concern bidder qualifications (e.g. previous references, liquidity requirements) and requirements related to the very specific technological design (e.g. grid connection standards).

5.1 Material pre-qualification

Material pre-qualification requirements require standardized evidence of the project’s progress. Examples include a grid connection agreement, an environmental permit, or an approved zoning/development plan. They serve to ensure a high probability of realization, since the projects participating in the auction have already overcome some of the risks related to project planning (e.g. securing a location, permits, etc.). Material pre-qualification create sunk costs for the developer, i.e. they are not reimbursed in case of not winning the bid. According to auction theory, a rational bidder will not consider sunk cost when calculating their indifference value. High sunk costs can therefore prevent market actors from participating in the auction, thus limiting competition. For the auctioneer, the examination of material pre-qualification requirements may lead to transaction costs and a longer period required for the bid evaluation.

5.2 Financial guarantees (bid bonds)

To further increase the seriousness of the bid or to reduce sunk cost from material pre-qualifications, the auctioneer can require bidders to submit financial guarantees, so called bid bond. Such guarantees typically back up penalties that are due in case of delay or failure to realize a project. Financial guarantees are usually secured in the form of an external bank guarantee by a certified institution. This removes the need for the auctioneer to assess the credit worthiness and/or liquidity of the bidder.

6. Obligations, deadlines and penalties

After the auction. After the auction, bidders have a certain time to realize the project - the “realization period”. If they fail to comply, they usually face penalties. Other design elements of relevance after the auction concerns the possibility to transfer the awarded contract from one project to another, contracting, payment duration, etc. The following discusses the realization period and penalties in greater detail. They are crucial in determining weather or not awarded projects are realized (in a timely manner), which in turn effects the effectiveness of the auction. At the same time, they need to provide sufficient flexibility to the bidders as otherwise the penalty risk increases cost.

Realization period. The realization period specifies the validity time of the award. Projects need to be commissioned before its end. An appropriate length depends on the technology, the project development timeline, and the pre-qualification criteria chosen. In Germany, for instance, solar PV projects need to be commissioned within 18 months (penalty-free), while onshore wind projects have 24 months. The realization period can be divided by milestones which are monitored by the auctioneer, something commonly observed for large projects with long realization periods, such as offshore wind.

Penalties. If the realization period is exceeded, penalties can be imposed. They counteract delays and/or the non-realization of projects. They are also intended to prevent bidders with no intention to build projects from “hoarding” awards, as such behavior compromises target achievement. Penalties can take several forms including the termination of contracts, lowering price levels, shortening contract validity periods by the time of the delay, or the confiscation of bid bonds/financial guarantees (Kreiss et al. 2017).

Penalty risk. The enforceability of penalties can be secured by requiring guarantees or deposits (see above) and so prevent their circumvention in case of bankruptcy of the bidder. However, penalties also increase risks and can thereby increase overall costs, since bidders will price the penalty risk into their bids. One way to limit the penalty risk is to implement staggered penalties instead of automatically terminating the contract in case a project is experiencing delays. Who should bear the penalty risk. Limiting the penalty risk in auctions also means that a project developer should only be sanctioned for the delays she is responsible for and that she can effectively address (Held at al. 2014). For example, if a delay occurs because of complications in the supply chain, this is a regular part of project development against which the project developer can conclude private contracts for risk mitigation. However, if a delay is caused by problems in public permitting procedures, it may be wiser that the project developer is not subject to a penalty.

7. Institutional set-up

Who plays a role in auctions? This category groups design elements dealing with the institutional architecture in which an auction system operates. Several institutional actors are required for the auction design and implementation. Here, the structure of the electricity market plays a role. The allocation of responsibilities to certain institutions, as well as the competences and resources at their disposal, have an impact on reaching the auction’s goals. It is thus important to identify relevant actors early in the process: the authority which would be responsible for drafting the legal structure for the auctions, the auctioneer, the bodies responsible for issuing permits and licenses, the regulatory agency which will commission the projects, and the entity who will buy the electricity from the project. The two most important actors beside the bidders are the auctioneer and the contract off-taker.

The auctioneer. The auctioneer is the entity responsible for setting up the auction, as well as receiving and ranking the bids. The auctioneer evaluates the offers based on price and other criteria, and, in some countries, signs a power purchase agreement with the successful bidder. In electricity sectors characterized by the single buyer model, where there is no independent system operator, the auctioneering competence may be given to an independent regulatory agency. In countries with a wholesale electricity market or undergoing reforms towards a more liberalized electricity sector, the independent system operator could be the auctioneer.

The contract off-taker. Similarly, defining who the contract off-taker will be is key because there will be a payment stream to the project developer after commissioning. The contract off-taker is the entity that signs the contract with the winner and becomes responsible for the payments. In single buyer model electricity sectors, a state-owned company may play the role of the contract off-taker, though other public-private entities have also acted as contract off-takers in the past.

Summary and outlook. This chapter gave an overview on the auction design for renewable energies. It defined auctions as competitive, very formalized allocation mechanisms for a predefined good, here energy produced from renewable sources. Policy makers hope to discover the “real price” and “bring down cost” all while having control over the volume.

The chapter focused on how to design an auction and gave an overview on the relevant design criteria: general design elements, the auction procedure, eligibility requirements, obligations, deadlines and penalties, and the institutional set-up. They were defined, and the advantages and disadvantages were described. Thereby the chapter focused on providing a kind of manual for designing auctions.

To learn more on the functioning and pros and cons of auctions, two very relevant streams of the literature focus on understanding and interpreting results of auctions, and the effect of decreasing prices for renewables on the bidder’s strategies and the functioning of auctions themselves. Furthermore, the world of auctions in the energy sector is not limited to renewables. They exist in many parts of the electricity market, e.g. for balancing power.